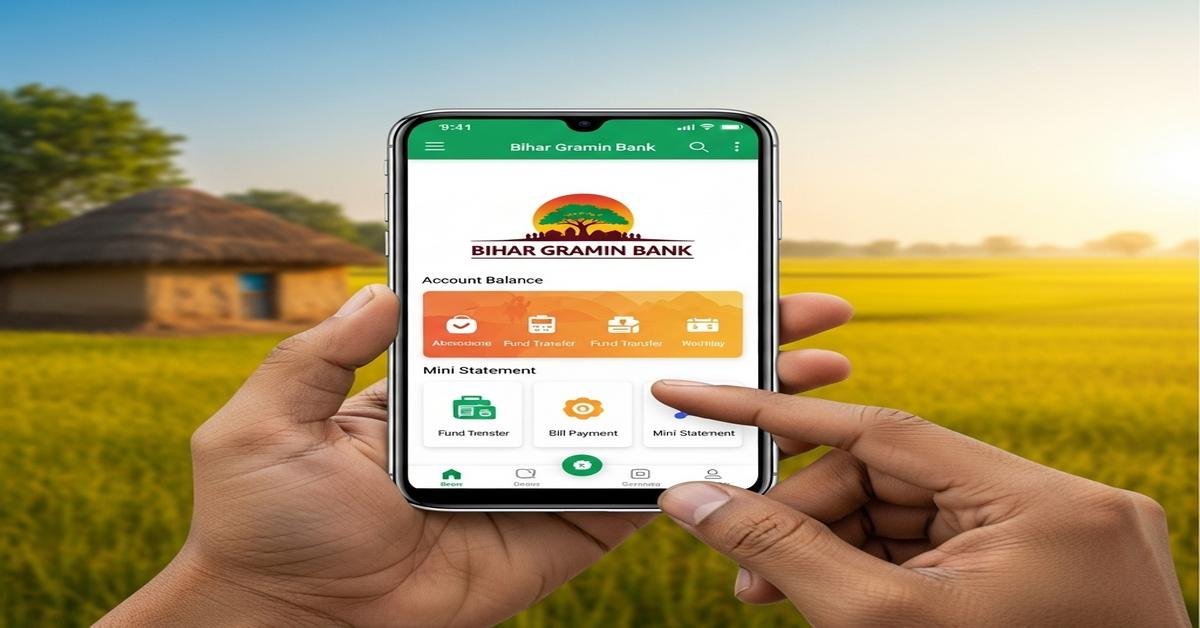

The Bihar Gramin Bank mobile banking app has changed how many rural and semi-urban customers manage money. It brings core banking services to a smartphone. That reduces visits to branches and makes small daily banking tasks quick and secure. In this article I explain the app’s main features, how to set it up, the security behind it, and practical tips you can use right away.

Features of the mobile app

- Account overview: instant view of account balance, account type and branch details so you don’t need to visit the branch just to check balances.

- Mini-statement: quick access to recent transactions (typically the last 5–10 entries) to verify debits and credits without a passbook.

- Fund transfers: NEFT and IMPS for sending money to other banks, often supported from within the app for immediate or scheduled transfers.

- Beneficiary & profile management: add, approve or delete payees, and update basic profile details tied to your account.

- Notifications & alerts: push notifications and SMS for credits, debits, failed transactions, and low-balance warnings so you can act quickly.

- Security controls: MPIN/biometric login, OTP validation for high-risk actions, and in-app options to change PIN or block access.

View balance & mini-statement

The primary convenience is real-time balance and a short transaction history. The mini-statement usually lists the last 5–10 entries with date, amount and type (debit/credit). Why this matters: you can spot unauthorized debits quickly and reconcile small payments (for example, ATM withdrawals or direct deposits). If you rely on monthly passbook updates, the app removes that delay. For salaried customers or pension beneficiaries, an immediate credit alert removes uncertainty about receipt timing.

Fund transfer: NEFT and IMPS

The app supports bank-to-bank transfers using NEFT and IMPS. Use IMPS for instant transfers that need to arrive immediately. Use NEFT when you prefer a bank-settled transaction; NEFT is robust for larger amounts and often used for vendor or bill payments. Typical steps: choose transfer type, select or add beneficiary, enter amount and remarks, authenticate with OTP/MPIN. The app keeps a log of transfers for later verification. Why this matters: it replaces the queue at the branch or the need to write cheques, and it gives a digital receipt you can save for record-keeping.

Profile & beneficiary management

Adding a beneficiary usually requires entering the beneficiary name, account number and IFSC. Many banks enforce a cooling period for new beneficiaries or require OTP re-validation before first use. This two-step process reduces fraud by stopping instant misuse of newly added payees. From a practical view, maintain a short, verified list of payees you use regularly—this reduces typing errors and accidental transfers. If you need to pay a new vendor, add them and do a small test transfer (for example, Rs. 1–10) to confirm accuracy before sending larger sums.

Notifications & alerts

The app sends push notifications plus the traditional SMS alerts. Typical alerts include credits (salary, transfers), debits (transactions, standing instructions), failed transactions, and low-balance warnings. Why push matters: push notifications are immediate and cheaper than SMS. SMS remains useful as a backup if you change phones. Enable both if you want redundancy for important transaction alerts.

How to download & register

- Confirm your mobile number is registered with the bank; most registration and OTP flows rely on that number.

- Go to Google Play (Android) or the App Store (iOS) and search for the official Bihar Gramin Bank app. Check the publisher is the bank to avoid fake apps.

- Install and open the app. Choose “Register” or “First Time User”. You will usually need your account number or CIF and the registered mobile number.

- Enter the required details and wait for the OTP (normally a 6-digit code) on the registered mobile. Enter the OTP to verify the device.

- Set a secure MPIN (4–6 digits) and, if available, enable biometric login (fingerprint or face) for faster access on your device.

If the mobile number on file is different, update it at your branch before attempting registration. The bank cannot verify you without the registered number.

Security and PIN reset

The app uses layered security: device registration, MPIN, OTP for critical actions, and typically encryption for data in transit. Biometric login (fingerprint/face) links your device to your identity and prevents casual access if the phone is stolen. Why this combination matters: MPIN blocks remote attackers; OTP prevents unauthorized transfers; biometrics speeds access without exposing the numeric PIN.

To reset a forgotten MPIN you normally use the “Forgot MPIN” option in the app, which sends an OTP to the registered mobile. Some banks also require additional verification like debit card details or a visit to the branch for re-activation. If your phone is lost, contact the bank immediately to block mobile banking and replace the SIM if the attacker could receive your OTP.

Practical tips

- Keep your registered mobile number current at the branch. Most app functions depend on it.

- Use a strong MPIN and enable biometric login if available. Don’t write the PIN on paper kept with your phone.

- Install app updates promptly. Updates fix security issues and add useful features.

- Avoid public Wi‑Fi for banking. Use your mobile data or a trusted network.

- Verify IFSC and account number before saving a beneficiary. Do a small test transfer to confirm details.

- Enable push notifications and SMS alerts to detect unauthorized activity early.

FAQs (short answers)

- What if my mobile number is not registered? Update it at your branch with ID verification. You cannot activate mobile banking without the registered number.

- Can I register multiple accounts on the same phone? Many apps allow multiple accounts if they are under the same customer profile; follow the in-app instructions to link another account.

- What if I forget my MPIN? Use the in-app “Forgot MPIN” flow which uses an OTP to the registered mobile. You may need debit card details or branch visit depending on bank policy.

- Is there a charge to use the app? Basic balance checks and mini-statements are usually free. Fund transfers may carry standard charges per the bank’s schedule. Check the price schedule in the app or at the branch.

The Bihar Gramin Bank mobile app simplifies daily banking for customers outside major cities. It replaces simple branch visits with secure digital steps. Use the app for routine tasks, follow the security tips here, and keep the bank informed when your contact details change. That combination makes mobile banking both convenient and safe.

Kritti Kumari is a banker and MBA graduate who writes about banking, finance, and customer-friendly services. She simplifies complex financial products into easy guides, helping readers understand Bihar Gramin Bank’s offerings and make smarter money decisions.