Bihar Gramin Bank’s mPassbook is a mobile app that gives account holders a digital version of the paper passbook. It shows deposits, withdrawals, balance and transaction details on your phone. You do not need full internet banking to use it — the app uses the mobile number registered with the bank and an OTP to link your account. This article explains how the mPassbook works, who can use it, how to register, what features to expect, common use cases, advantages over a physical passbook, important limitations, practical tips, and answers to frequently asked questions.

What is mPassbook

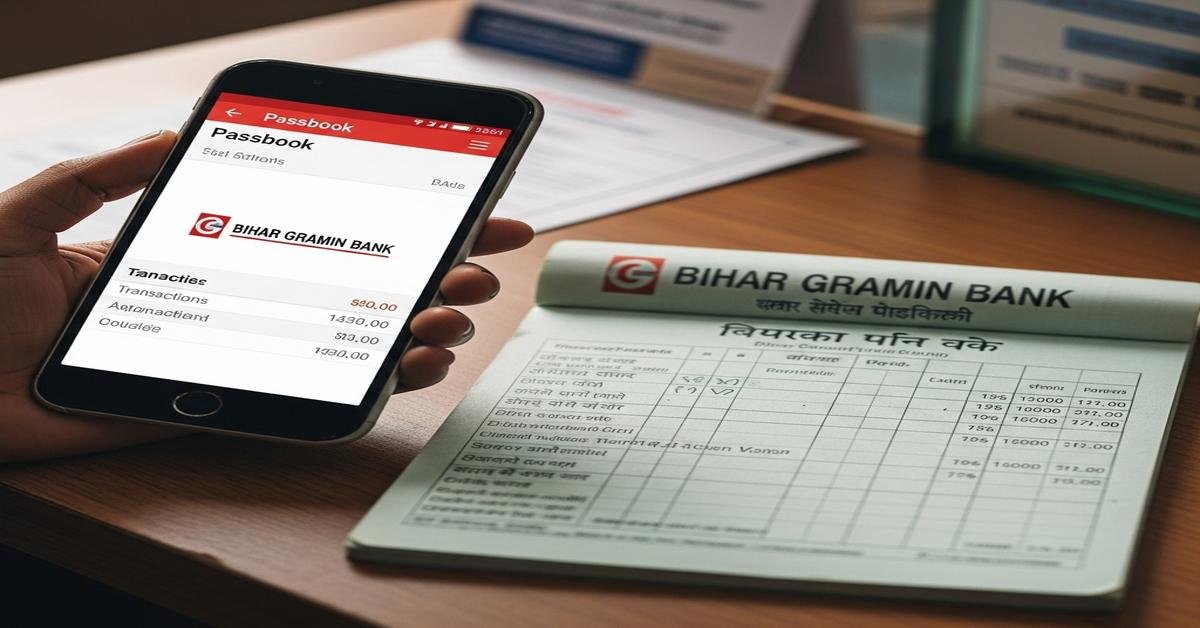

The mPassbook is a bank-provided mobile application that stores and displays transaction entries similar to a paper passbook. It replaces manual entries with electronic records. The app usually shows date, transaction type (withdrawal, deposit, transfer), amount, running balance and a transaction reference or instrument number. Bihar Gramin Bank’s mPassbook aims to give immediate visibility into your account without visiting a branch.

Who can use it (even without net banking)

You can use mPassbook if:

- Your account is active with Bihar Gramin Bank.

- Your current mobile number is registered with the bank. This is essential because registration is verified by OTP sent to that number.

- You have a smartphone (Android or iPhone) and a working internet connection for initial setup and sync.

You do not need separate internet banking credentials. The app uses OTP and your account details (account number or CIF) to link your account. That is why customers who never registered for net banking can still use mPassbook — the app performs a lightweight authentication tied to the mobile number, not full internet-banking access.

How to register

- Download the Bihar Gramin Bank mPassbook app from the Google Play Store or Apple App Store. Look for the bank name in the developer info to confirm authenticity.

- Open the app and choose “Register” or “Add Account.”

- Enter your bank account number or CIF and the mobile number registered with the bank.

- Verify the OTP sent to your mobile number.

- Create a secure MPIN (4–6 digits) or enable biometric login if your phone supports it.

- Select the account(s) to show in the app. The app will sync and download recent transactions.

If the app cannot register, visit the branch to ensure your mobile number is properly linked to the account or ask customer care to activate mobile services for mPassbook use.

Features (real-time updates)

Key features of Bihar Gramin Bank’s mPassbook:

- Instant balances: After each sync, you see the current available balance. For immediate credits like IMPS/UPI, this will reflect almost instantly. For batch processes like NEFT (late evening batches) or cheque clearing, the update follows settlement timing.

- Transaction details: Date, amount, transaction type, reference number and balance after each entry — useful for reconciliation and dispute resolution.

- Search and filter: Filter by date range or search by amount or reference to find entries faster than flipping paper pages.

- Export/Download: Many apps let you export a statement as PDF or CSV for printing or filing.

- Offline view: After sync, transactions remain viewable offline until next refresh. This helps when you have no network while travelling.

- Auto-sync or manual sync: You can set automatic sync frequency or refresh manually before a branch visit.

Use cases (checking entries, stale entries)

- Checking entries quickly: Use the app when you need to confirm a credit (salary or transfer) or check if an EMI or direct debit has been deducted.

- Stale or pending entries: If you deposited a cheque, the app may show a “pending” or “under process” status until clearing completes. Similarly, inward NEFT/RTGS may show timestamps and reference numbers but will reflect final balance only after settlement. This is why some entries appear stale for a few hours or days depending on transaction type.

- Proof before visiting branch: Sync and show the latest PDF or screenshot to bank staff when you need quick verification. This saves time compared with opening a fresh paper passbook.

Advantages over physical passbook

- Speed: No branch visit. Sync takes seconds to minutes. This matters when you need to confirm a transfer or show a balance immediately.

- Searchable history: You can find transactions by amount, date or reference. A paper passbook requires flipping pages.

- Backup and export: Export as PDF/CSV for tax, loan applications or record keeping. A paper passbook is a single physical copy that can be lost or damaged.

- Multiple accounts: View several accounts in one app. Physically carrying multiple passbooks is inconvenient.

- Security: App access is protected by MPIN/biometrics. A lost physical passbook can be misused unless reported.

Limitations & tips

mPassbook is powerful, but it has limits. Know them before relying on it solely.

- Requires smartphone and data: Without a phone or internet, you cannot register or sync. Keep an updated offline PDF if you travel to areas with no network.

- Not always legally equivalent: For some official processes, institutions may still request a stamped physical passbook or bank statement signed by the branch. Check requirements before submitting mPassbook prints as proof.

- History limits: The app may show only recent months (for example, 6–12 months). For older history, request a printed statement from the bank.

- Pending transactions: Understand transaction types. Immediate credits (IMPS/UPI) reflect fast. Cheques and some NEFT batches take time. Don’t assume an absent entry means loss; check the transaction status and clearing cycles.

- Security tips: Keep your mobile number up to date with the bank. Use MPIN and biometric lock. Don’t use public Wi‑Fi for financial activity and update the app when new versions release.

FAQs

Q: Can mPassbook fully replace my physical passbook?

A: For everyday tracking and quick proof of balance, yes. For formal legal or specific branch procedures, banks or institutions may still ask for a stamped physical passbook or official bank statement. Keep a physical passbook or request a printed statement when necessary.

Q: What if my mobile number isn’t registered?

A: You must register your mobile number with Bihar Gramin Bank at the branch. Without it you can’t receive the OTP needed to link the mPassbook.

Q: I don’t see older transactions. Why?

A: The app often caches recent months only. Older entries remain in the bank’s core system. Ask the branch for a printed statement for longer history or request a customized statement for the period you need.

Q: Is mPassbook free?

A: Most banks provide the mPassbook app free for customers. However, data charges from your mobile operator may apply for syncing.

Q: What to do if I lose my phone?

A: Inform the bank immediately and request deactivation of mobile services. Change credentials and MPIN from a new device after re-registration. Use branch support if necessary.

mPassbook from Bihar Gramin Bank is a practical tool for daily account management. It speeds up checks and reduces branch visits. Use it alongside occasional printed statements for official needs and follow basic security steps to keep your financial information safe.

Kritti Kumari is a banker and MBA graduate who writes about banking, finance, and customer-friendly services. She simplifies complex financial products into easy guides, helping readers understand Bihar Gramin Bank’s offerings and make smarter money decisions.