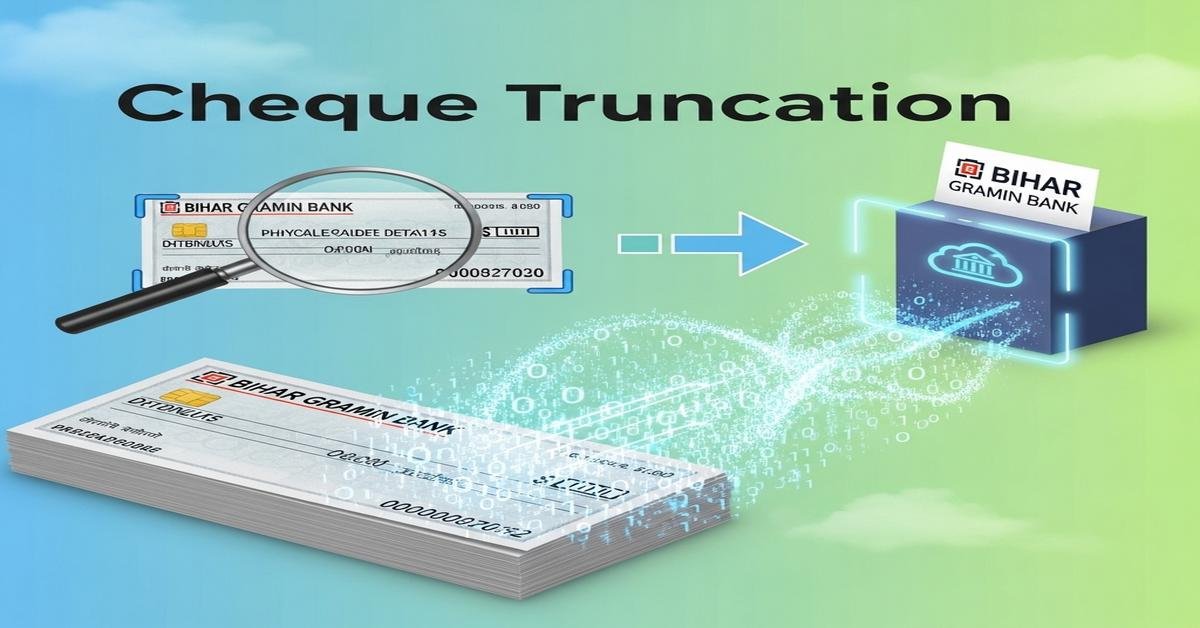

Bihar Gramin Bank, like many Indian banks, now uses cheque truncation and e-cheque processing to clear cheques without moving the original paper across cities. Instead of physically carrying a cheque from the branch where it was deposited to the drawer’s bank, the bank captures a high-resolution image and the MICR data, transmits them electronically, and completes settlement through the clearing system. This article explains how that works, why it matters, and what customers should know.

What is an e-cheque / cheque truncation?

Cheque truncation means stopping the physical movement of the cheque and using its image and encoded data for clearing. The bank captures a scanned image of the cheque, reads the MICR line (the numbers at the bottom), and sends both to the clearing house. The original paper stays with the presenting bank for a defined period.

E-cheque often refers to a cheque presented and processed entirely by electronic transmission of its image and data. In India, the Reserve Bank has approved image-based clearing systems. That makes a scanned cheque image legally acceptable for clearing and settlement.

Benefits: why truncation speeds things up and lowers cost

- Faster clearance. Electronic images travel instantly. That usually converts a multi-day physical transit into same-day or next-day processing. Faster clearance reduces float and gives customers quicker access to funds.

- Lower cost. Transporting physical cheques involves courier costs, logistics and handling staff. Scanning and electronic transmission cut those costs for banks and, indirectly, for customers.

- Less risk of loss or damage. Cheques in transit can be lost, torn, or smudged. Images preserve the legibility that clearing systems need.

- Better audit trail. Electronic files include timestamps and metadata. That helps trace disputes and prevents tampering.

Process flow: step-by-step

- 1. Deposit. A customer hands a cheque to Bihar Gramin Bank (presenting bank) at a branch or drop-box.

- 2. Capture. The bank scans the cheque using a certified scanner. The image and MICR line are extracted. The bank may also capture an image of any endorsement on the back.

- 3. Validation at source. The presenting bank checks image quality, legibility of payee name and amount, MICR read quality, and endorsement. If something is wrong, the bank may seek a fresh cheque or return it as defective.

- 4. Transmit to clearing house. The presenting bank sends the cheque image package to the clearing house. The clearing house can be run by the central bank, a clearing corporation, or a regional clearing authority depending on location.

- 5. Sorting / presentment. The clearing house sorts the images and forwards them electronically to the drawee bank (the bank that holds the drawer’s account).

- 6. Drawee bank verification. The drawee bank verifies signature, available funds, stop instructions and any other conditions. It then either honors the cheque or returns it with a reason code.

- 7. Settlement. Net positions are settled among banks through the interbank settlement system (accounts maintained at the central bank). The presenting bank receives credit or a return message based on the outcome.

- 8. Retention. The presenting bank retains the physical cheque for a stipulated period as per regulatory rules in case of disputes or legal requirements.

Roles: who does what

- Presenting bank (Depositor’s bank). Scans the cheque, checks image quality, and sends electronic presentment. For customers of Bihar Gramin Bank, the branch acts as the presenting bank.

- Clearing house. Routes images between banks, applies business rules, and produces settlement instructions. It enforces time windows and standard formats so all banks can interoperate.

- Drawee/Paying bank. Verifies the signature, amount and account status. It has the final say on payment or return.

- Customer. Initiates the deposit and may need to act if a cheque image is unclear or if the cheque is returned.

How customers are affected

- Faster access to funds. Most cheques clear faster. That helps individuals and small businesses manage cash flow.

- Quicker returns and disputes. If a cheque is returned, the presenting bank gets the return message quickly. That speeds resolution but also shortens the window to correct issues.

- Evidence is electronic. If a signature is disputed, the cheque image is the first piece of evidence. Physical cheques are kept, but the image is what drives clearing.

- Depositing at remote branches or drop-boxes. Even when you deposit at a remote location, the image enables fast processing. But ensure endorsements are clear and the cheque is intact to avoid rejection.

Digital image vs paper cheque: key differences

- Speed. Image clears faster. Physical movement is the bottleneck for paper cheques.

- Quality control. Image-based systems require legible handwriting and clear endorsements. Smudged or faint ink that might have been readable in person can fail an automatic quality check.

- Legal standing. In India, image-based presentment is accepted in the clearing system. The original physical cheque may still be required for litigation or forensic checks, so banks retain it for a set period.

- Fraud profile. Image systems reduce some frauds (loss in transit) but introduce others (image manipulation). Banks mitigate this by using secure transmission, digital signatures, watermarking and audit logs.

Limitations and common failure points

- Poor image quality. Faint ink, colour contrasts, or torn cheques can fail automated checks and be returned.

- Signature mismatches. If the drawee bank suspects a forged signature, it will return the cheque. Image-only review makes signature checks harder than inspecting the original under magnification, though banks use enhanced tools.

- System outages. Scanners, transmission links or clearing house systems can go down. That delays clearing until services resume.

- Different rules for special cheques. Certain cheques — like government or cross-border items — may need special handling or the physical cheque for settlement.

FAQs

- How long will my cheque take to clear? Most image-presented cheques clear faster than physically moved cheques. Expect same-day or next-day processing for standard local cheques, but timelines can vary by clearing cycle and bank cutoffs.

- Can a cheque still be returned? Yes. Reasons include insufficient funds, signature mismatch, stale cheque, or poor image quality. The bank will send a return message with a reason code.

- Is a scanned cheque legally valid? Yes for clearing. RBI-approved image-based clearing recognizes cheque images for settlement. However, banks keep originals for a set retention period and the original may be needed in court or for forensic checks.

- What if my cheque image is rejected? The presenting bank will inform you. You may need to re-present a fresh cheque with clearer writing or a different payment method.

- Can I deposit a cheque remotely using my phone? Remote deposit via mobile is growing, but it depends on whether Bihar Gramin Bank offers a secure mobile deposit feature. Remote deposit requires certified imaging and secure transmission protocols.

Cheque truncation and e-cheque processing are practical upgrades. They speed up cash flow, cut costs and create clearer audit trails. Customers must write legibly, endorse correctly, and watch return messages — because the image, not the physical cheque in transit, now drives clearance.

Kritti Kumari is a banker and MBA graduate who writes about banking, finance, and customer-friendly services. She simplifies complex financial products into easy guides, helping readers understand Bihar Gramin Bank’s offerings and make smarter money decisions.